Filed pursuant to Rule 497

File No. 333-178548

Supplement dated May 8, 2015

to

Prospectus dated April 30, 2015

_________________________________________

This supplement contains information which amends, supplements or modifies certain information contained in the Prospectus of HMS Income Fund, Inc. (the “Company”) dated April 30, 2015 (as supplemented and amended, the “Prospectus”). This supplement is part of, and should be read in conjunction with, the Prospectus. The Prospectus has been filed with the Securities and Exchange Commission and is available at www.sec.gov or by calling (888) 446-3773. Capitalized terms used in this supplement have the same meanings as in the Prospectus, unless otherwise stated herein.

You should carefully consider the “Risk Factors” beginning on page 27 of the Prospectus before you decide to invest.

This supplement updates the Prospectus (i) to reflect the addition of special suitability standards in Alabama, (ii) to reflect the entry by the Company’s subsidiary, HMS Funding I LLC, into the fourth amendment to its credit agreement with Deutsche Bank AG, New York Branch, as administrative agent and other banks as participants, and (iii) to update the Form of Subscription Agreement in Appendix A to the Prospectus.

________________________________________

This supplement amends the Prospectus as follows:

SUITABILITY STANDARDS

This supplement modifies the Prospectus (as supplemented) to include the following special suitability standards in Alabama on page (ii):

Alabama—In addition to the general suitability standards above, an Alabama investor must have a liquid net worth of at least 10 times such Alabama resident’s investment in HMS Income Fund, Inc. and its affiliates.

PROSPECTUS SUMMARY

This supplement replaces in its entirety the fourth and eighth paragraphs in the section entitled “Prospectus Summary-Credit Facilities” on page 9 of the Prospectus (as supplemented) with the following:

On June 2, 2014, our wholly-owned Structured Subsidiary, HMS Funding I LLC, a Delaware limited liability company (“HMS Funding”), entered into a credit agreement (the “HMS Funding Facility”) among HMS Funding, as borrower, the Company, as equityholder and as servicer, Deutsche Bank AG, New York Branch (“Deutsche Bank”), as administrative agent, the financial institutions party thereto as lenders (together with Deutsche Bank, the “HMS Funding Lenders”), and U.S. Bank National Association (the "Collateral Agent"), as collateral agent and collateral custodian. The HMS Funding Facility provided for an initial borrowing capacity of $50 million, subject to certain limitations, including limitations with respect to HMS Funding’s investments,

as more fully described in the HMS Funding Facility. On July 22, 2014, HMS Funding, the Company, Deutsche Bank and the Collateral Agent, entered into Amendment No. 1 to the HMS Funding Facility, pursuant to which the borrowing capacity under the HMS Funding Facility was increased to $100 million. On December 3, 2014, HMS Funding, the Company, Deutsche Bank and the Collateral Agent entered into Amendment No. 2 to the HMS Funding Facility, pursuant to which the borrowing capacity under the HMS Funding Facility was increased to $125 million. On February 4, 2015, HMS Funding, the Company, Deutsche Bank and the Collateral Agent entered into Amendment No. 3 to the HMS Funding Facility, pursuant to which the borrowing capacity under the HMS Funding Facility was increased to $200 million. On May 5, 2015, HMS Funding, the Company, Deutsche Bank and the Collateral Agent entered into Amendment No. 4 to the HMS Funding Facility, pursuant to which the borrowing capacity under the HMS Funding Facility was increased to $225 million. At HMS Funding’s request and upon approval by HMS Funding Lenders, the maximum borrowings under the HMS Funding Facility can be increased by up to an additional $25 million, in the aggregate, subject to certain limitations contained in the HMS Funding Facility, for a total maximum capacity of $250 million. We contribute certain assets to HMS Funding from time to time, as permitted under our Syndicated Credit Facility, as collateral to secure the HMS Funding Facility. The HMS Funding Facility matures on June 3, 2019.

As of May 5, 2015, we had $105 million outstanding and zero available under our Syndicated Credit Facility and had $199 million outstanding and $26 million available under the HMS Funding Facility (not including the accordion feature of either of our Credit Facilities), both of which we estimated approximated fair value and subject to certain limitations and the asset coverage restrictions under the 1940 Act.

RISK FACTORS

This supplement replaces the second and third paragraphs in the risk factor entitled “We may have limited ability to fund new investments if we are unable to expand, extend or refinance our Syndicated Credit Facility or the HMS Funding Facility.” on page 37 of the Prospectus (as supplemented) with the following:

On June 2, 2014, our wholly-owned subsidiary, HMS Funding I LLC, a Delaware limited liability company (“HMS Funding”), entered into a credit agreement (the “HMS Funding Facility”) among HMS Funding, the Company, as equityholder and servicer, Deutsche Bank AG, New York Branch (“Deutsche Bank”), and the financial institutions party thereto as lenders (together with Deutsche Bank, the “HMS Funding Lenders”). The HMS Funding Facility provided for an initial borrowing capacity of $50 million, subject to certain limitations, including limitations with respect to HMS Funding’s investments, as more fully described in the HMS Funding Facility. On July 22, 2014, the HMS Funding Facility capacity was increased to $100 million. On December 3, 2014, the HMS Funding Facility capacity was increased to $125 million. On February 4, 2015, the HMS Funding Facility capacity was increased to $200 million. On May 5, 2015, the HMS Funding Facility was increased to $225 million. At HMS Funding’s request and upon approval by HMS Funding Lenders, the maximum borrowings under the HMS Funding Facility can be increased by up to an additional $25 million, in the aggregate, subject to certain limitations contained in the HMS Funding Facility, for a total maximum capacity of $250 million. The HMS Funding Facility matures on June 3, 2019.

As of May 5, 2015, we had borrowings of $105 million outstanding on our Syndicated Credit Facility and had borrowings of $199 million outstanding on the HMS Funding Facility.

This supplement replaces the second paragraph in the risk factor entitled “Because we borrow money, the potential for gain or loss on amounts invested in us is magnified and may increase the risk of investing in us.” on page 38 of the Prospectus (as supplemented) with the following:

As of May 5, 2015, we had borrowings of $105 million outstanding on our Syndicated Credit Facility and had borrowings of $199 million outstanding on the HMS Funding Facility.

SENIOR SECURITIES

This supplement replaces in their entirety the fourth and eighth paragraphs in the section entitled “Senior Securities” on pages 48-49 of the Prospectus (as supplemented) with the following:

On June 2, 2014, HMS Funding entered into the HMS Funding Facility, which provided for an initial borrowing capacity of $50 million, subject to certain limitations, including limitations with respect to HMS Funding’s investments, as more fully described in the HMS Funding Facility. On July 22, 2014, HMS Funding, the Company, Deutsche Bank and U.S. Bank National Association, as collateral agent, entered into Amendment No. 1 to the HMS Funding Facility, pursuant to which the borrowing capacity under the HMS Funding Facility was increased to $100 million. On December 3, 2014, HMS Funding, the Company, Deutsche Bank and U.S. Bank National Association, as collateral agent, entered into Amendment No. 2 to the HMS Funding Facility, pursuant to which the borrowing capacity under the HMS Funding Facility was increased to $125 million. On February 4, 2015, HMS

Funding, the Company, Deutsche Bank and U.S. Bank National Association, as collateral agent, entered into Amendment No. 3 to the HMS Funding Facility, pursuant to which the borrowing capacity under the HMS Funding Facility was increased to $200 million. On May 5, 2015, HMS Funding, the Company, Deutsche Bank and U.S. Bank National Association, as collateral agent, entered into Amendment No. 4 to the HMS Funding Facility, pursuant to which the borrowing capacity under the HMS Funding Facility was increased to $225 million. At HMS Funding’s request and upon approval by HMS Funding Lenders, the maximum borrowings under the HMS Funding Facility can be increased by up to an additional $25 million, in the aggregate, subject to certain limitations contained in the HMS Funding Facility, for a total maximum capacity of $250 million. We contribute certain assets to HMS Funding from time to time, as permitted under our Syndicated Credit Facility, as collateral to secure the HMS Funding Facility. The HMS Funding Facility matures on June 3, 2019.

As of May 5, 2015, we had $105 million outstanding under our Syndicated Credit Facility and had $199 million outstanding under the HMS Funding Facility. Accordingly, as of May 5, 2015, we had drawn the full capacity of our Syndicated Credit Facility and had $26 million available under the HMS Funding Facility (not including the accordion feature of either of our Credit Facilities) subject to certain limitations and the asset coverage restrictions under the 1940 Act, as discussed below.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

This supplement replaces the fifth and eighth paragraphs in the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Liquidity and Capital Resources - Capital Resources” on pages 66-67 of the Prospectus (as supplemented) with the following:

On June 2, 2014, our wholly-owned Structured Subsidiary, HMS Funding I LLC, a Delaware limited liability company (“HMS Funding”), entered into a credit agreement (the “HMS Funding Facility”) among HMS Funding, as borrower, the Company, as equityholder and as servicer, Deutsche Bank AG, New York Branch (“Deutsche Bank”), as administrative agent, the financial institutions party thereto as lenders (together with Deutsche Bank, the “HMS Funding Lenders”), and U.S. Bank National Association (the "Collateral Agent"), as collateral agent and collateral custodian. The HMS Funding Facility provided for an initial borrowing capacity of $50 million, subject to certain limitations, including limitations with respect to HMS Funding’s investments, as more fully described in the HMS Funding Facility. On July 22, 2014, HMS Funding, the Company, Deutsche Bank and the Collateral Agent entered into Amendment No. 1 to the HMS Funding Facility, pursuant to which the borrowing capacity under the HMS Funding Facility was increased to $100 million. On December 3, 2014, HMS Funding, the Company, Deutsche Bank and the Collateral Agent entered into Amendment No. 2 to the HMS Funding Facility, pursuant to which the borrowing capacity under the HMS Funding Facility was increased to $125 million. On February 4, 2015, HMS Funding, the Company, Deutsche Bank and the Collateral Agent entered into Amendment No. 3 to the HMS Funding Facility, pursuant to which the borrowing capacity under the HMS Funding Facility was increased to $200 million. On May 5, 2015, HMS Funding, the Company, Deutsche Bank and the Collateral Agent entered into Amendment No. 4 to the HMS Funding Facility, pursuant to which the borrowing capacity under the HMS Funding Facility was increased to $225 million. At HMS Funding’s request and upon approval by HMS Funding Lenders, the maximum borrowings under the HMS Funding Facility can be increased by up to an additional $25 million, in the aggregate, subject to certain limitations contained in the HMS Funding Facility, for a total maximum capacity of $250 million. We contribute certain assets to HMS Funding from time to time, as permitted under our Syndicated Credit Facility, as collateral to secure the HMS Funding Facility. The HMS Funding Facility matures on June 3, 2019.

As of May 5, 2015, we had approximately $105 million outstanding and zero available under our Syndicated Credit Facility and had $199 million outstanding and $26 million available under the HMS Funding Facility (not including the accordion feature of either of our Credit Facilities), subject to certain limitations and the asset coverage restrictions under the 1940 Act.

This supplement inserts the eighth paragraph in the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Recent Developments and Subsequent Events” on page 69 of the Prospectus (as supplemented) with the following:

On May 5, 2015, our wholly-owned Structured Subsidiary, the Company, Deutsche Bank and the Collateral Agent entered into the Fourth Amendment to the HMS Funding Facility increasing the borrowing capacity to $225 million. No other terms or conditions were modified as a result of this agreement.

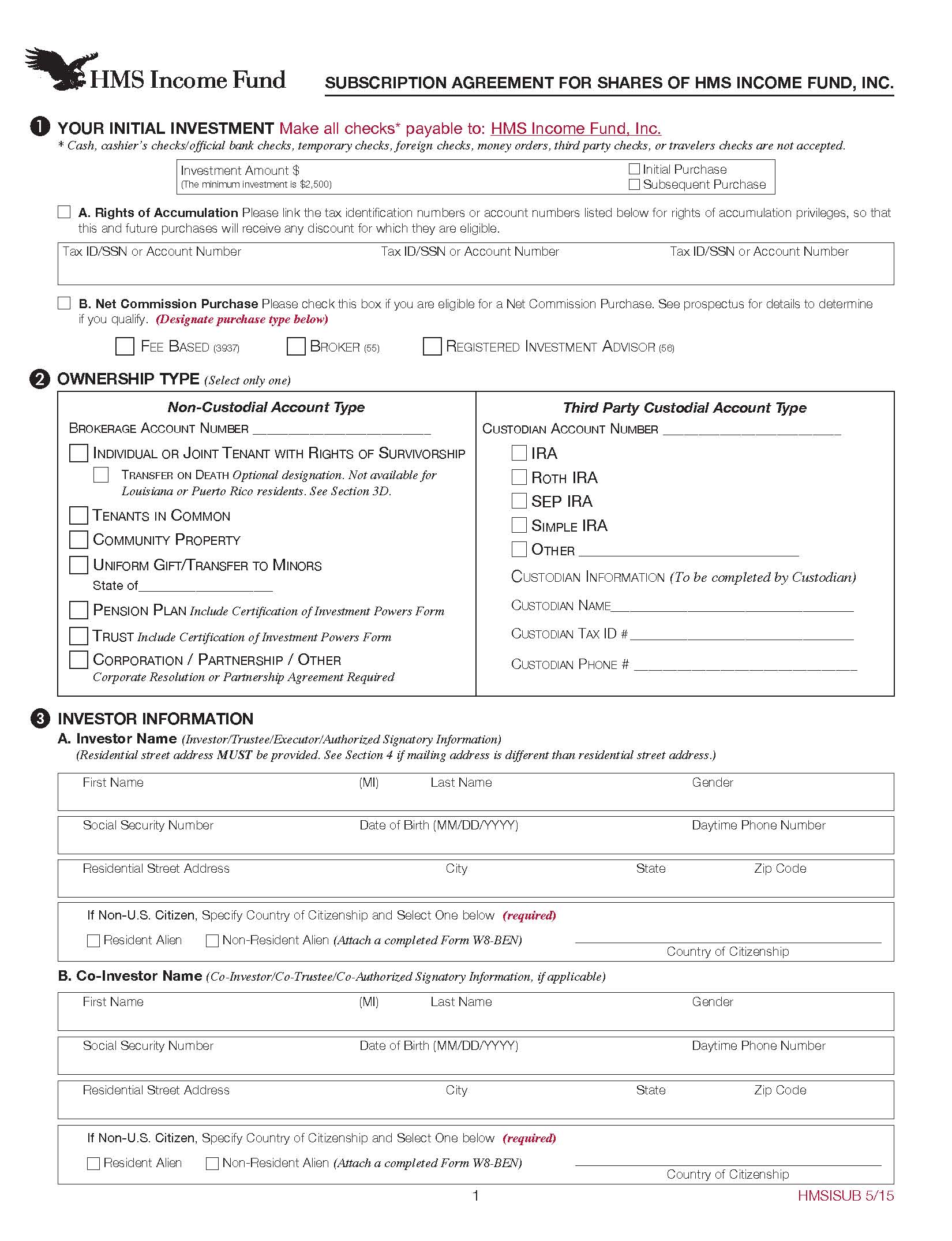

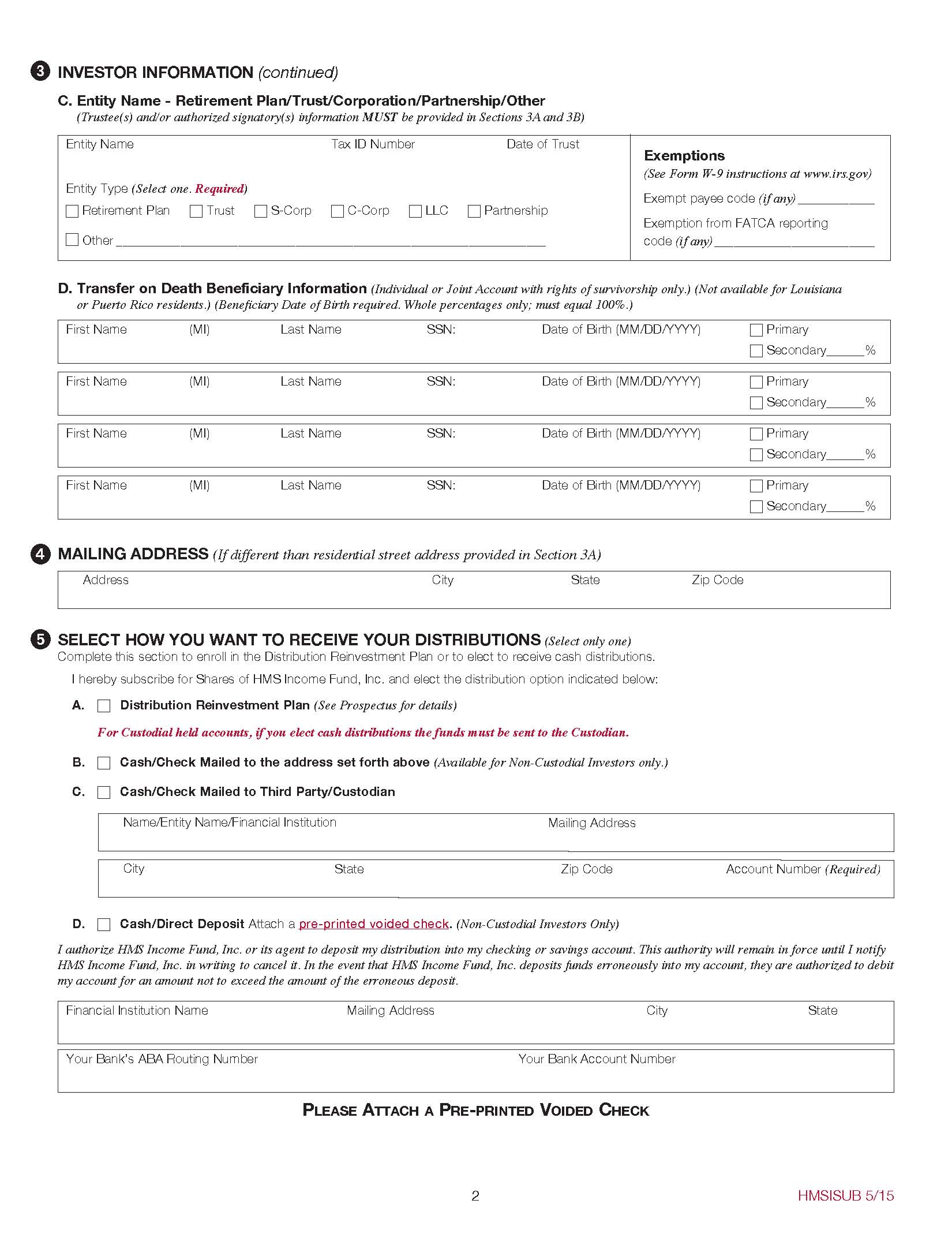

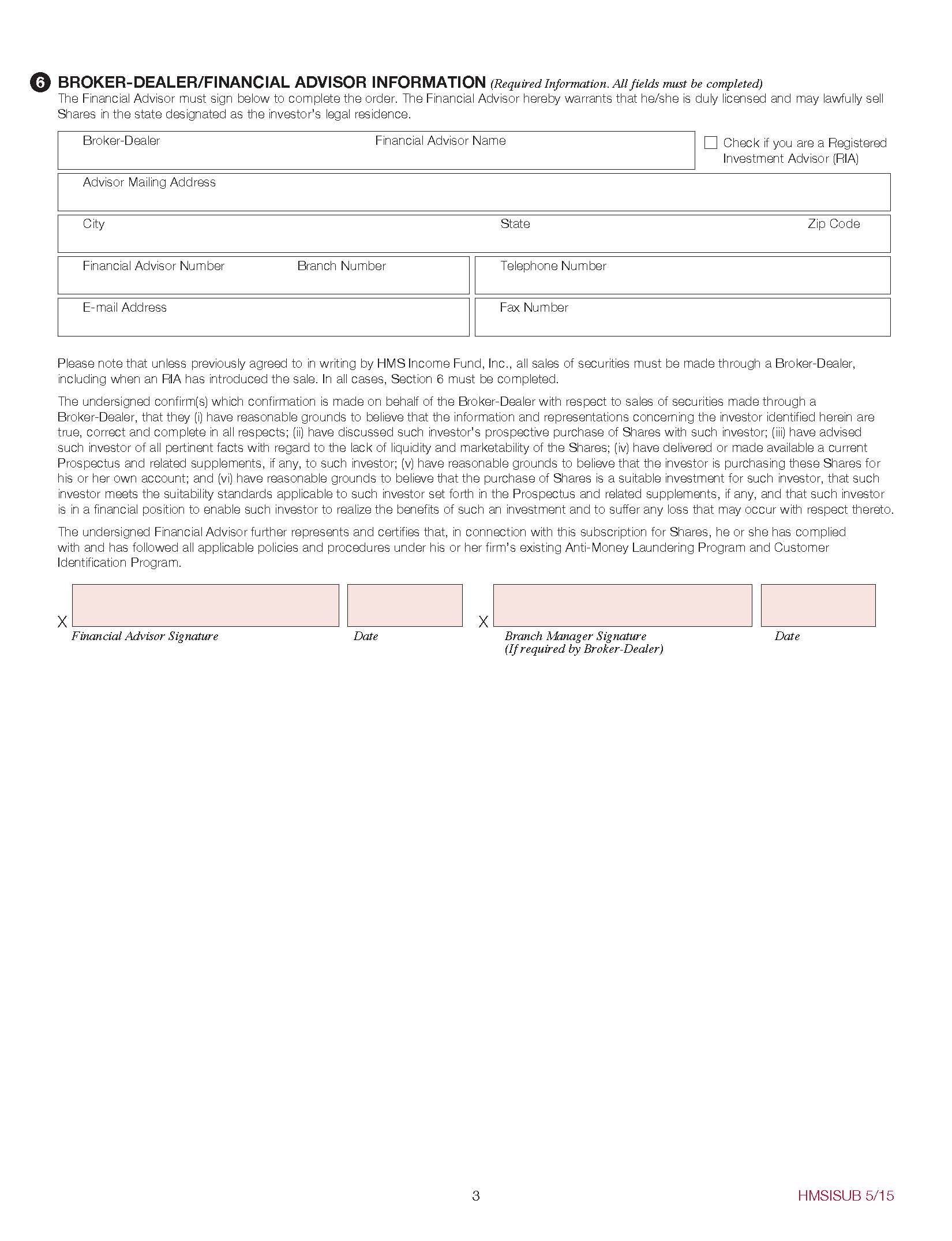

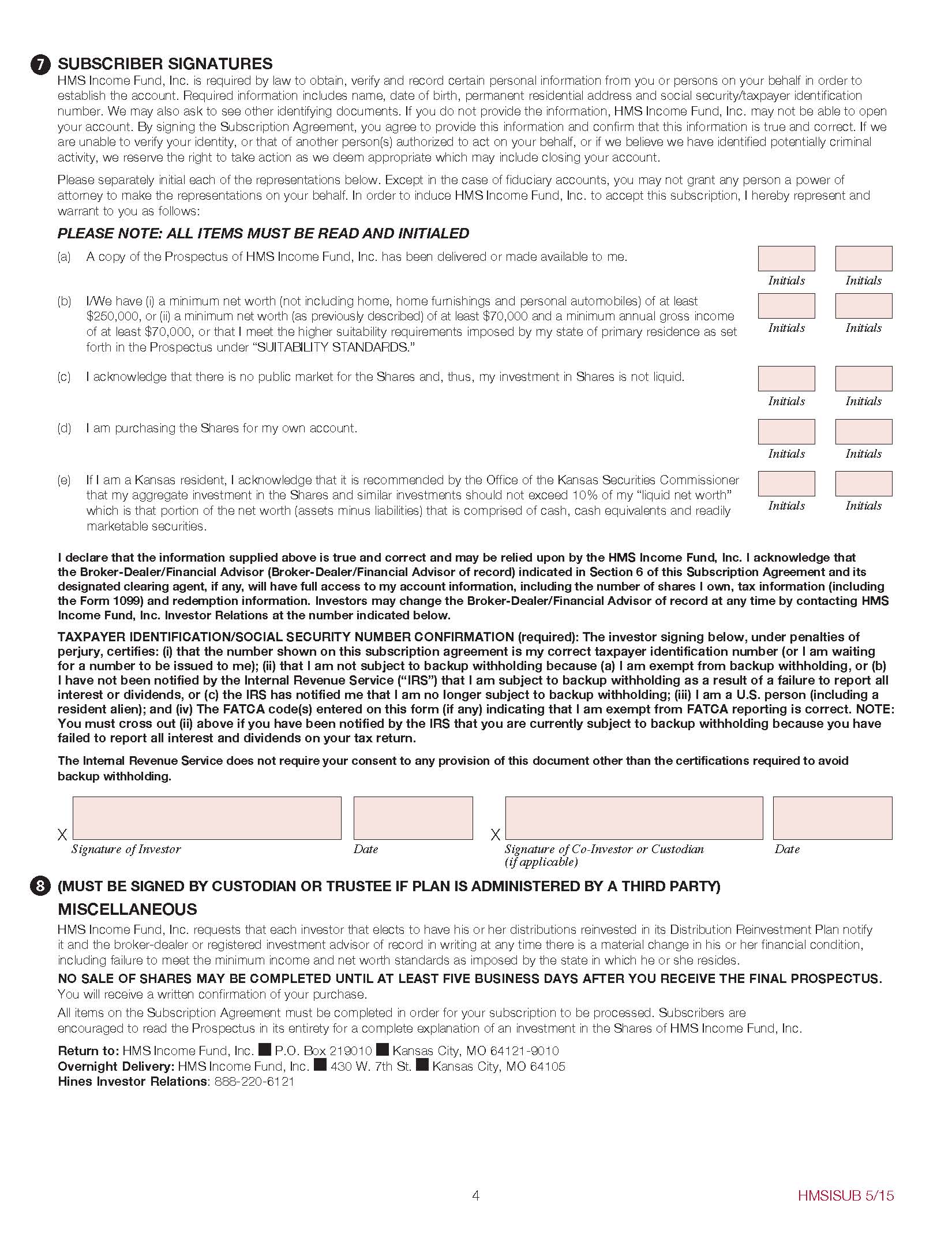

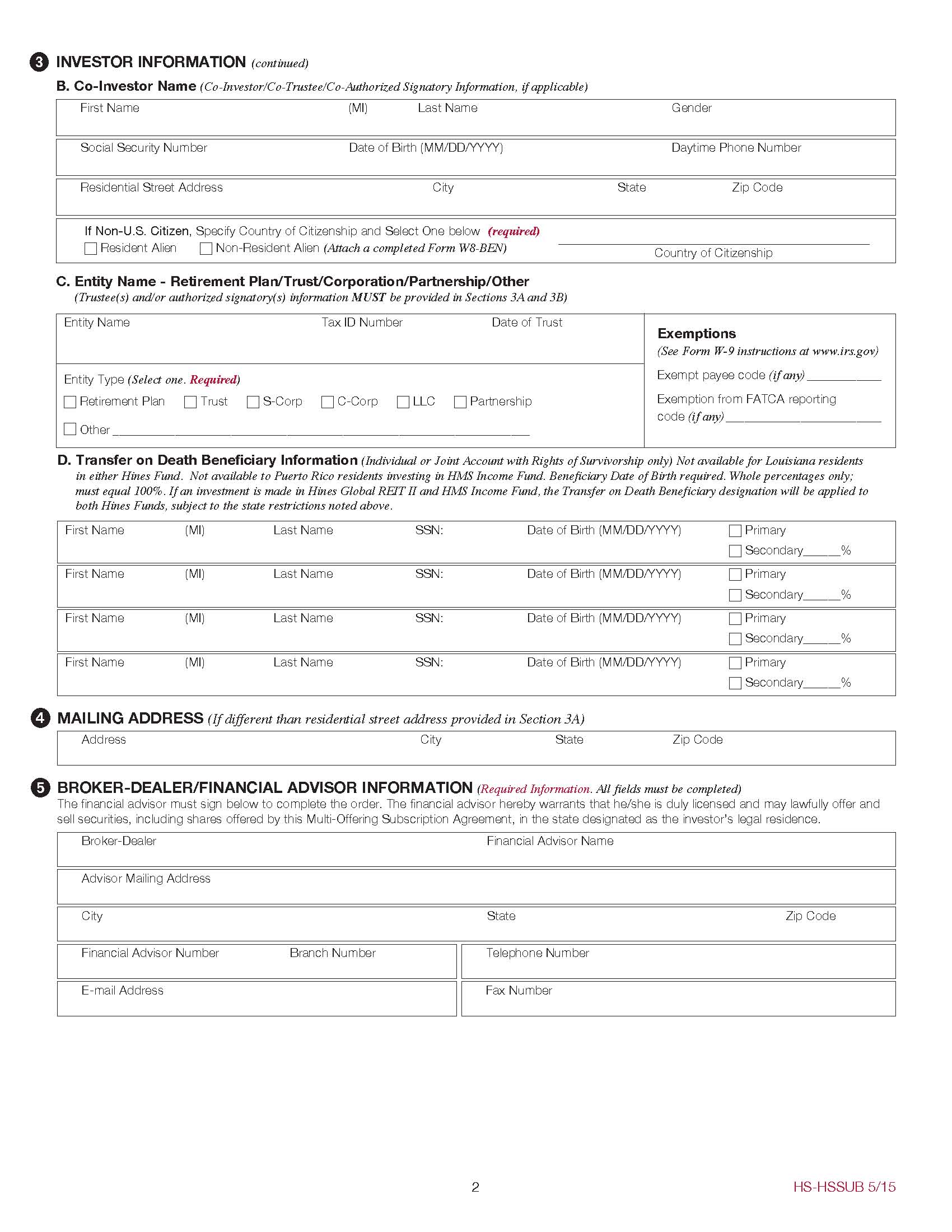

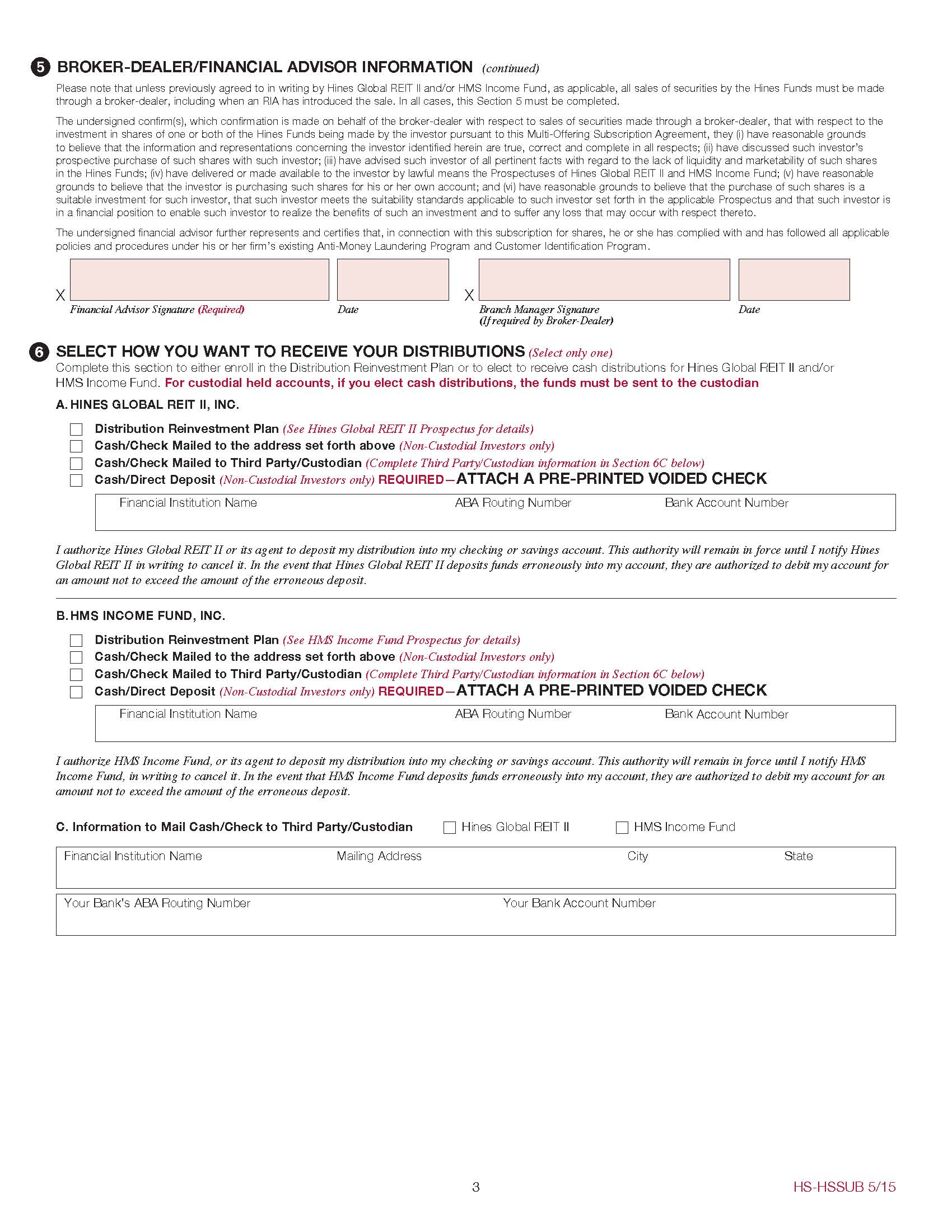

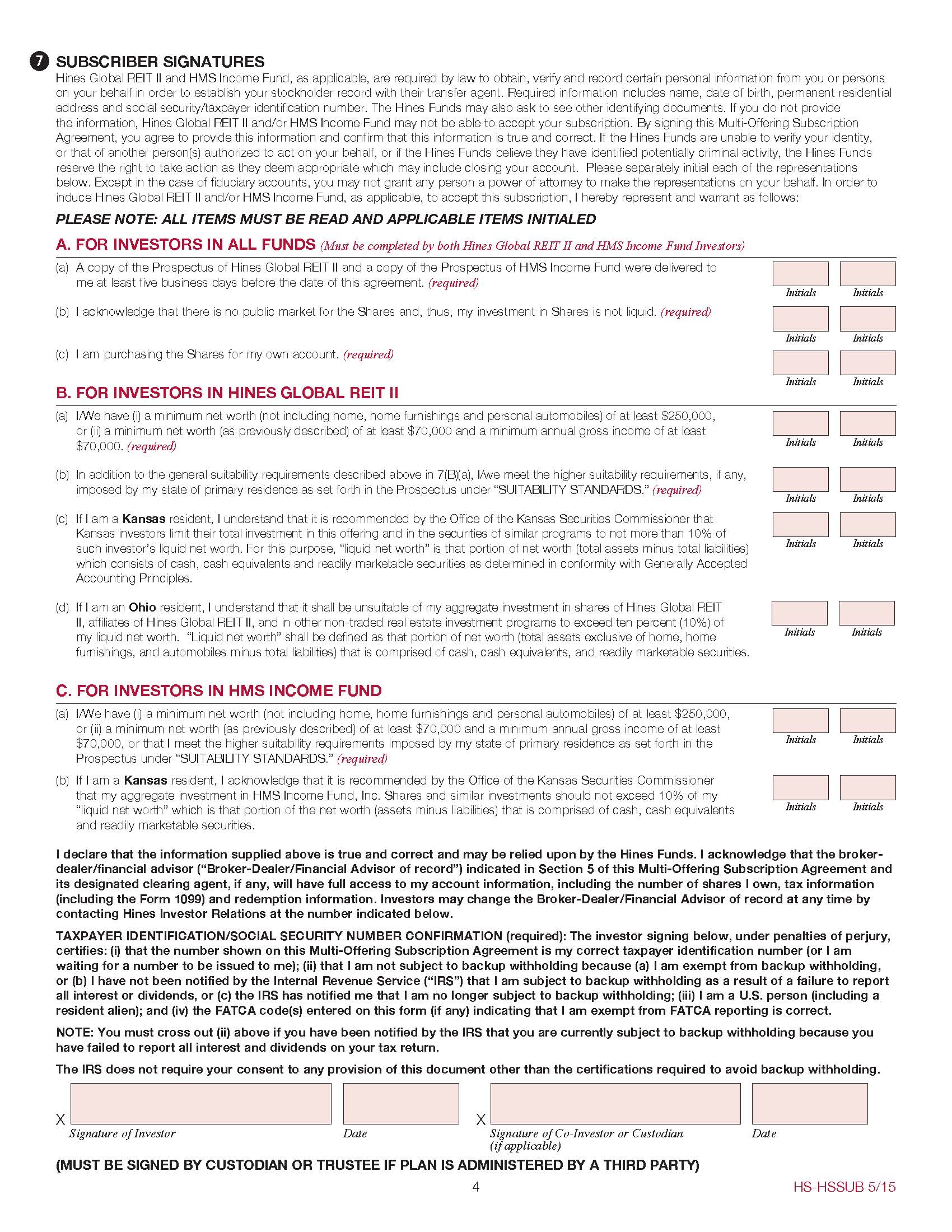

SUBSCRIPTION PROCESS

This supplement replaces in its entirety the form of subscription agreement in Appendix A to the Prospectus.