As filed with the Securities and Exchange Commission on August 12, 2016October 5, 2016

1933 Act File No. 333-204659

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

__________________________

FORM N-2

_________________________

(Check Appropriate Box or Boxes)

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Pre-Effective Amendment No. Post-Effective Amendment No. 12

__________________________

HMS INCOME FUND, INC.

(Exact Name of Registrant as Specified in Charter)

__________________________

2800 POST OAK BOULEVARD, SUITE 5000

HOUSTON, TEXAS 77056-6118

Address of Principal Executive Offices (Number, Street, City, State, Zip Code)

Registrant’s Telephone Number, Including Area Code: (888) 220-6121

SHERRI W. SCHUGART

HMS INCOME FUND, INC.

2800 POST OAK BOULEVARD, SUITE 5000

HOUSTON, TEXAS 77056-6118

Name and Address (Number, Street, City, State, Zip Code) of Agent For Service

__________________________

COPIES TO:

Thomas J. Friedmann

William J. Tuttle

William J. Bielefeld

Dechert LLP

1900 K Street, NW

Washington, DC 20006

(202) 261-3300

Martin H. Dozier

Alston & Bird LLP

1201 West Peachtree Street

Atlanta, Georgia 30309

(404) 881-7000

________________________

Approximate Date of Proposed Public Offering: As soon as practicable after the effective date of this Registration Statement.

If any securities being registered on this form will be offered on a delayed or continuous basis in reliance on Rule 415 under the

Securities Act of 1933, other than securities offered in connection with a distribution reinvestment plan, check the following box.

It is proposed that this filing will become effective (check appropriate box):

when declared effective pursuant to section 8(c).

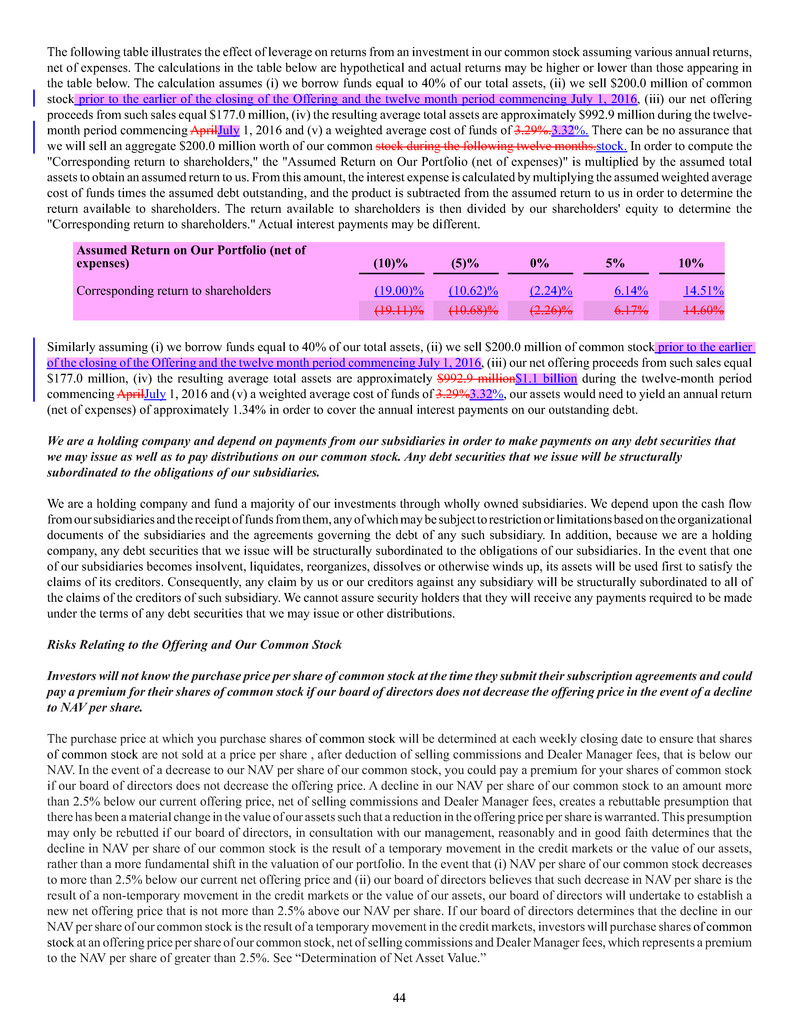

_______________________________________

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

Registrant shall file an amendment which specifically states that this Registration Statement shall thereafter become effective in accordance

with Section 8(c) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as

the Securities and Exchange Commission, acting pursuant to Section 8(c), may determine.

The information in this preliminary prospectus is not complete and may be changed. The securities may not be sold until the registration

statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these

securities, and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED AUGUST 12, 2016OCTOBER 5, 2016

PROSPECTUS

HMS INCOME FUND, INC.

MAXIMUM OFFERING OF $1,500,000,000 OF COMMON STOCK

HMS Income Fund, Inc. is offering on a continuous basis up to $1,500,000,000 of our common stock at a current offering price of

$8.90 per share through our Dealer Manager (the "Offering"). To the extent that our net asset value ("NAV") per share increases, however,

we will sell shares of our common stock at a price necessary to ensure that shares of our common stock are not sold at a price per share,

after deduction of selling commissions and Dealer Manager fees, that is below our NAV per share. In the event of a material decline in

our NAV per share that we deem non-temporary and which results in a 2.5% or more decrease of our NAV per share below our then-

current net offering price, and subject to certain other conditions, we will reduce our offering price accordingly. Any changes in our public

offering price will be disclosed in one or more supplements to this prospectus.

Because of the possibility that the price per share will change, persons who subscribe for shares in this Offering must submit

subscriptions for a fixed dollar amount rather than for a number of shares and, as a result, may receive fractional shares of our common

stock. The maximum upfront sales load is 10.0% of the amount invested for such shares. The initial minimum permitted purchase price

is $2,500 in shares. We currently conduct our closings on a weekly basis. All subscription payments are placed in a segregated interest-

bearing account and held in trust for our subscribers’ benefit, pending release to us at the next scheduled weekly closing.

Prospective investors should note:

• The Company’s shares are not listed on an exchange, and it is not anticipated that a secondary market will develop.

Thus, an investment in the Company may not be suitable for investors who may need the money they invest in a specified

timeframe. If an investor is able to sell its shares, it will likely receive less than its purchase price.

• The amount of distributions that the Company may pay, if any, is uncertain.

• The Company may, for the foreseeable future, pay a portion of distributions from sources other than net realized income

from operations and from sources that may not be available in the future, which may include stock offering proceeds,

borrowings, fee and expense waivers from HMS Adviser LP, our investment adviser, and MSC Adviser I, LLC, our

investment sub-adviser (together, our "Advisers"), and support payments from HMS Adviser LP.LP and returns of

capital.

• An investor will pay a sales load of 10% and offering expenses of up to 1.5% on the amounts invested. If you pay the

maximum aggregate 11.5% for sales load and offering expenses, you must experience a total return on your net investment

of 13.0% in order to recover these expenses.

We are a specialty finance company sponsored by Hines Interests Limited Partnership. Our primary investment objective is to

generate current income through debt and equity investments. A secondary objective is to generate long-term capital appreciation through

equity and equity-related investments, including warrants, convertible securities, and other rights to acquire equity securities. We pursue

a strategy focused on investing primarily in senior secured term loans, second lien loans and mezzanine debt and selected equity investments

issued by lower middle market ("LMM") and middle market ("Middle Market") companies that are generally larger in size than the LMM

companies. Our LMM companies generally have annual revenues between $10 million and $150 million, and our LMM portfolio

investments generally range in size from $1 million to $15 million. Our Middle Market investments are made in businesses that are

generally larger in size than our LMM portfolio companies, with annual revenues typically between $10 million and $3 billion. Our

Middle Market investments generally range in size from $1 million to $15 million.

Most debt securities in which we invest will not be rated, or if they were rated by a rating agency, would be rated below investment

grade. Such below investment grade debt securities are commonly known as “junk” securities and are regarded as having predominantly

speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal. Moreover, such debt securities are

typically illiquid and may be difficult to value.

We are an externally managed, non-diversified, closed-end management investment company that has elected to be treated as a

business development company ("BDC") under the Investment Company Act of 1940, as amended (the "1940 Act").

Our shares are not listed on any exchange, and we do not have any current intention to list our shares. We do not expect a secondary

market in our shares to develop, so you should not expect to be able to sell your shares regardless of how we perform. You should consider

that you may not have access to the money you invest for an indefinite period of time and that you will be unable to reduce your exposure

in any market downturn. An investment in our shares is not suitable for you if you need access to the money you invest (see “Share

Repurchase Program” and “Suitability Standards” in this prospectus).

We have provided limited liquidity to our shareholders by means of quarterly tender offers for the lesser of approximately 2.5% per

quarter of our weighted average number of outstanding shares for the trailing four quarters or the number of shares we can repurchase

with the proceeds we receive from the sale of shares of our common stock under our distribution reinvestment plan during the trailing

four quarters. Such quarterly tender offers allow our stockholders to sell their shares back to us. We currently intend to continue making

quarterly tender offers for our shares. Any tender offers will be made at a price equal to the NAV per share determined within 48 hours

prior to the repurchase date.

Subject to the approval of our board of directors, we intend to make quarterly distributions. If we have not earned enough income

to distribute, our distributions may be funded from stock offering proceeds or borrowings, which may constitute a return of capital and

reduce the amount of capital available to us for investment. Any capital returned to stockholders through distributions will be distributed

after payment of fees and expenses.

Our previous distributions were not based entirely on our investment performance, but were partially funded by fee waivers agreed

to by our investment adviser and our investment sub-adviser, and by expense reimbursements from our investment adviser, which may

be subject to repayment. If our investment adviser and investment sub-adviser had not agreed to waive their fees and our investment

adviser had not agreed to reimburse some of our expenses, these distributions may have come from your paid-in capital. Reimbursement

of these waived fees and expenses could reduce future distributions to which you would otherwise be entitled.

Investing in shares of our common stock may be considered speculative and involves a high degree of risk, including the

risk of a substantial loss of investment. See “Risk Factors” beginning on page 31 to read about the risks you should consider

before purchasing shares of our common stock, including the risk of leverage.

This prospectus contains important information about us that a prospective investor should know before investing in shares of our

common stock. Please read this prospectus before investing and keep it for future reference. We file annual, quarterly and current reports,

proxy statements and other information about us with the Securities and Exchange Commission (the "SEC") as required. This information

is available free of charge by contacting us at 2800 Post Oak Boulevard, Suite 4700, Houston, Texas 77056-6118 or by telephone collect

at (888) 220-6121 or on our website at www.HinesSecurities.com. Information contained on our website is not incorporated by reference

into this prospectus, and you should not consider that information to be part of this prospectus. The SEC also maintains a website at

www.sec.gov that contains such information.

Neither the SEC, the Attorney General of the State of New York nor any state securities commission has approved or

disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a

criminal offense. Except as specifically required by the 1940 Act and the rules and regulations thereunder, the use of forecasts is

prohibited and any representation to the contrary and any predictions, written or oral, as to the amount or certainty of any

present or future cash benefit or tax consequence which may flow from an investment in shares of our common stock is not

permitted.

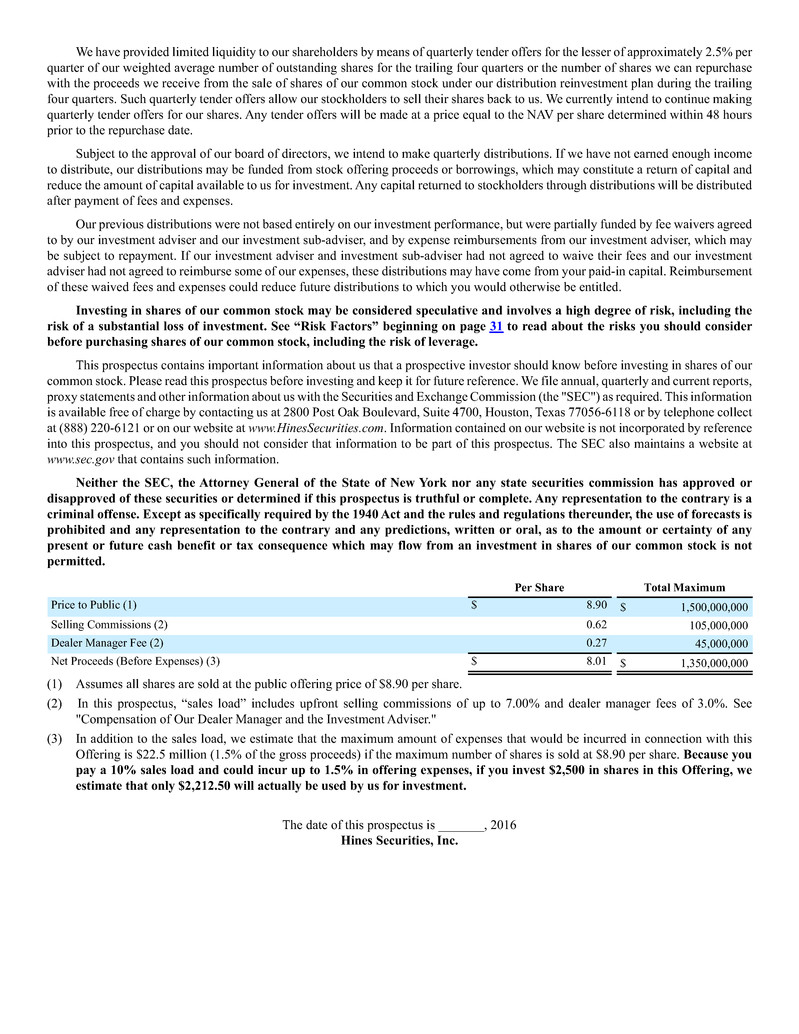

Per Share Total Maximum

Price to Public (1) $ 8.90 $ 1,500,000,000

Selling Commissions (2) 0.62 105,000,000

Dealer Manager Fee (2) 0.27 45,000,000

Net Proceeds (Before Expenses) (3) $ 8.01 $ 1,350,000,000

(1) Assumes all shares are sold at the public offering price of $8.90 per share.

(2) In this prospectus, “sales load” includes upfront selling commissions of up to 7.00% and dealer manager fees of 3.0%. See

"Compensation of Our Dealer Manager and the Investment Adviser."

(3) In addition to the sales load, we estimate that the maximum amount of expenses that would be incurred in connection with this

Offering is $22.5 million (1.5% of the gross proceeds) if the maximum number of shares is sold at $8.90 per share. Because you

pay a 10% sales load and could incur up to 1.5% in offering expenses, if you invest $2,500 in shares in this Offering, we

estimate that only $2,212.50 will actually be used by us for investment.

The date of this prospectus is _______, 2016

Hines Securities, Inc.

i

HMS INCOME FUND, INC.

TABLE OF CONTENTS

ABOUT THE PROSPECTUS

SUITABILITY STANDARDS

PROSPECTUS SUMMARY

FEES AND EXPENSES

COMPENSATION OF OUR DEALER MANAGER AND THE INVESTMENT ADVISER

QUESTIONS AND ANSWERS ABOUT THIS OFFERING

SELECTED FINANCIAL DATA

RISK FACTORS

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

ESTIMATED USE OF PROCEEDS

DISTRIBUTIONS

SENIOR SECURITIES

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

WHAT YOU SHOULD EXPECT WHEN INVESTING IN A BDC

INVESTMENT OBJECTIVE AND STRATEGIES

DETERMINATION OF NET ASSET VALUE

PORTFOLIO COMPANIES

MANAGEMENT

PORTFOLIO MANAGEMENT

INVESTMENT ADVISORY AND ADMINISTRATIVE SERVICES AGREEMENT

ADMINISTRATIVE SERVICES

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

CONTROL PERSONS AND PRINCIPAL STOCKHOLDERS

DISTRIBUTION REINVESTMENT PLAN

DESCRIPTION OF OUR SECURITIES

MATERIAL U.S. FEDERAL INCOME TAX CONSIDERATIONS

REGULATION

PLAN OF DISTRIBUTION

LIQUIDITY STRATEGY

SHARE REPURCHASE PROGRAM

CUSTODIAN, TRANSFER AND DISTRIBUTION PAYING AGENT AND REGISTRAR, AND ESCROW

AGENT

BROKERAGE ALLOCATION AND OTHER PRACTICES

LEGAL MATTERS

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

AVAILABLE INFORMATION

PRIVACY NOTICE

INDEX TO FINANCIAL STATEMENTS

APPENDIX A: FORM OF SUBSCRIPTION AGREEMENT

ii

ii

1

16

18

21

22

26

31

49

50

51

55

57

79

80

88

90

100

106

109

118

118

121

123

124

133

140

143

148

148

149

149

150

150

150

151

F-1

A-1

ii

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we have filed with the SEC to register a continuous offering of our shares of

common stock. Periodically, as we make material investments or have other material developments, we will provide a prospectus

supplement that may add, update or change information contained in this prospectus. We will endeavor to avoid interruptions in the

continuous offering of our shares of common stock, including, to the extent permitted under the rules and regulations of the SEC, filing

post-effective amendments to the registration statement to include new annual audited financial statements as they become available.

There can be no assurance, however, that our continuous offering will not be suspended while the SEC completes its review of any such

amendment.

Any statement that we make in this prospectus may be modified or superseded by us in a subsequent prospectus supplement or post-

effective amendment. The registration statement we have filed with the SEC includes exhibits that provide more detailed descriptions of

certain matters discussed in this prospectus. You should read this prospectus and the related exhibits filed with the SEC and any prospectus

supplement, together with additional information described below under “Available Information.” In this prospectus, we use the term

“day” to refer to a calendar day, and we use the term “business day” to refer to any day other than Saturday, Sunday, or a federal holiday.

You should rely only on the information contained in this prospectus. Neither we, nor our Dealer Manager has authorized any other person

to provide you with different information from that contained in this prospectus. The information contained in this prospectus is complete

and accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or sale of our common stock. If

there is a material change in the affairs of our company, we will amend or supplement this prospectus.

SUITABILITY STANDARDS

The following are our suitability standards for investors which are required by the Omnibus Guidelines published by the North American

Securities Administrators Association ("NASAA") in connection with our continuous offering of shares of common stock under this

registration statement.

Pursuant to applicable state securities laws, shares of common stock offered through this prospectus are suitable only as a long-term

investment for persons of adequate financial means who have no need for liquidity in this investment. Initially, there is not expected to

be any public market for the shares, which means that it will be difficult for stockholders to sell their shares. As a result, we have established

suitability standards which require investors to have either (i) a net worth (not including home, furnishings, and personal automobiles)

of at least $70,000 and an annual gross income of at least $70,000, or (ii) a net worth (not including home, furnishings, and personal

automobiles) of at least $250,000. Our suitability standards also require that a potential investor (1) be positioned to reasonably benefit

from an investment in shares of our common stock based on such investor’s overall investment objectives and portfolio structuring; (2)

be able to bear the economic risk of the investment based on the prospective stockholder’s overall financial situation; and (3) have apparent

understanding of (a) the fundamental risks of the investment, (b) the risk that such investor may lose his or her entire investment, (c) the

lack of liquidity of the shares, (d) the background and qualifications of our Advisers and (e) the tax consequences of the investment.

In addition, certain states impose heightened suitability standards on investors. We will not sell shares to investors in the states named

below unless they meet special suitability standards.

Alabama—In addition to the general suitability standards above, an Alabama investor must have a liquid net worth of at least 10

times such Alabama resident’s investment in HMS Income Fund, Inc. and its affiliates.

Arizona — The term of this offering shall be effective for a period of one year with the ability to renew for additional periods of

one year.

California — In addition to the suitability standards above, an investor will limit his or her investment in HMS Income Fund, Inc.

common stock to a maximum of 10% of his or her net worth. An investment by a California investor that is an accredited investor

within the meaning of the Federal securities laws (17 C.F.R. §230.501) is not subject to the foregoing limitations.

Idaho — Investors who reside in the state of Idaho must have either (i) a liquid net worth of $85,000 and annual gross income of

$85,000 or (ii) a liquid net worth of $300,000. Additionally, an Idaho investor’s total investment shall not exceed 10% of his or her

liquid net worth. The calculation of liquid net worth shall include only cash plus cash equivalents. Cash equivalents include assets

which may be convertible to cash within one year.

Iowa — Investors who reside in the state of Iowa must have either (i) a liquid net worth of $100,000 and annual gross income of

$100,000 or (ii) a liquid net worth of $350,000. Additionally, an Iowa investor’s total investment in HMS Income Fund, Inc. shall

not exceed 10% of his or her liquid net worth. For this purpose, liquid net worth is determined exclusive of home, home furnishings

and automobiles. An investment by an Iowa investor that is an accredited investor within the meaning of the Federal securities laws

(17 C.F.R. §230.501) is not subject to the foregoing limitations.

iii

Kansas — The Office of the Kansas Securities Commissioner recommends that you should limit your aggregate investment in

HMS Income Fund, Inc. shares and other similar investments to not more than 10% of your liquid net worth. Liquid net worth is

that portion of your total net worth (assets minus liabilities) that is comprised of cash, cash equivalents and readily marketable

securities.

Kentucky — The issuer is a business development company. As such, a Kentucky investor must have either (i) a minimum annual

gross income of $70,000 and a minimum net worth of at least $70,000 or (ii) a minimum liquid net worth of at least $250,000. In

addition, no Kentucky investor shall invest, in aggregate, more than 10% of his or her liquid net worth in the Issuer or Issuer’s

affiliate’s non-publicly traded business development companies. For this purpose, “liquid net worth” is defined as that portion of

a person’s net worth (total assets, exclusive of home, home furnishings and automobiles minus total liabilities) that is comprised of

cash, cash equivalents and readily marketable securities.

Maine — The Maine Office of Securities recommends that an investor’s aggregate investment in this offering and similar direct

participation investments not exceed 10% of the investor’s liquid net worth. For this purpose, “liquid net worth” is defined as that

portion of net worth that consists of cash, cash equivalents and readily marketable securities.

Massachusetts — Investors who reside in the state of Massachusetts must have either (i) a minimum of $100,000 annual gross

income and a liquid net worth of $100,000; or (ii) a liquid net worth of $250,000 irrespective of gross annual income. Additionally,

a Massachusetts investor’s total investment in HMS Income Fund, Inc. and in other illiquid direct participation programs shall not

exceed 10% of his or her liquid net worth. For this purpose, liquid net worth is determined exclusive of home, home furnishings

and automobiles.

Nebraska — Nebraska investors who do not meet the definition of “accredited investor” as defined in Rule 501(a) promulgated

under the Securities Act of 1933, as amended, must have (i) either (a) an annual gross income of at least $100,000 and a net worth

of at least $100,000, or (b) a net worth of at least $350,000; and (ii) must limit their aggregate investment in this offering and in the

securities of other non-publicly traded business development companies (BDCs) to 10% of such investor’s net worth. (Net worth

in each case should be determined exclusive of home, home furnishings, and automobiles.)

New Jersey — Investors who reside in the state of New Jersey must have either (i) a minimum liquid net worth of $100,000 and

a minimum annual gross income of $85,000, or (ii) a minimum liquid net worth of $350,000. Additionally, a New Jersey investor’s

total investment in us, our affiliates, and other non-publicly traded direct investment programs (including real estate investment

trusts, business development companies, oil and gas programs, equipment leasing programs, and commodity pools, but excluding

unregistered, federally and state exempt private offerings) may not exceed 10% of such investor’s liquid net worth. For these

purposes, “liquid net worth” is defined as that portion of net worth (total assets exclusive of home, home furnishings, and automobiles,

minus total liabilities) that consists of cash, cash equivalents, and readily marketable securities.

New Mexico - In addition to the general suitability standards listed above, a New Mexico investor may not invest, and HMS Income

Fund may not accept from an investor more than ten percent (10%) of that investors’ liquid net worth in shares of HMS Income

Fund, its affiliates, and in other non-traded business development companies. Liquid net worth is defined as that portion of net

worth which consists of cash, cash equivalents, and readily marketable securities.

North Carolina — Investors who reside in the state of North Carolina must have either (i) a minimum liquid net worth of $85,000

and minimum annual gross income of $85,000 or (ii) a minimum liquid net worth of $300,000.

North Dakota — HMS Income Fund, Inc. shares will only be sold to residents of North Dakota representing that their investment

will not exceed 10% of his or her net worth and that they meet one of the established suitability standards.

Ohio — It shall be unsuitable for an Ohio investor's aggregate investment in shares of the issuer, affiliates of the issuer, and in other

non-traded business development companies to exceed ten percent (10%) of his or her liquid net worth. “Liquid net worth” shall

be defined as that portion of net worth (total assets exclusive of home, home furnishings, and automobiles minus total liabilities)

that is comprised of cash, cash equivalents, and readily marketable securities.

Oklahoma — Investors who reside in the state of Oklahoma who are not “accredited investors” within the meaning of the federal

securities laws must have either (i) an annual gross income of at least $100,000 and a net worth of at least $100,000, or (ii) a liquid

net worth of at least $250,000. Additionally, an Oklahoma investor’s total investment shall not exceed 10% of his or her liquid net

worth. For this purpose, liquid net worth is determined exclusive of home, home furnishings and automobiles.

Oregon — In addition to the suitability standards above, the state of Oregon requires that each Oregon investor will limit his or

her investment in HMS Income Fund, Inc. common stock to a maximum of 10% of his or her net worth (not including home, home

furnishings or automobiles).

Tennessee — We must sell a minimum of $15,000,000 worth of shares before accepting subscriptions from residents of Tennessee.

In addition, investors who reside in the state of Tennessee must have either (i) a minimum annual gross income of $100,000 and a

minimum net worth of $100,000 or (ii) a minimum net worth of $500,000 exclusive of home, home furnishings and automobile.

Additionally, Tennessee residents’ investment must not exceed 10% of their liquid net worth. An investment by a Tennessee investor

iv

that is an accredited investor within the meaning of the Federal securities laws (17 C.F.R. §230.501) is not subject to the foregoing

limitations.

Texas — Investors who reside in the state of Texas must have either (i) a minimum of $100,000 annual gross income and a liquid

net worth of $100,000 or (ii) a liquid net worth of $250,000 irrespective of gross annual income. Additionally, a Texas investor’s

total investment in HMS Income Fund, Inc. shall not exceed 10% of his or her liquid net worth. For this purpose, liquid net worth

is determined exclusive of home, home furnishings and automobiles.

Vermont — Investors who reside in the state of Vermont must have either (i) a minimum of $100,000 annual gross income and a

liquid net worth of $100,000 or (ii) a liquid net worth of $250,000 irrespective of gross annual income. Additionally, a Vermont

investor’s total investment in HMS Income Fund, Inc. shall not exceed 10% of his or her liquid net worth. For this purpose, liquid

net worth is determined exclusive of home, home furnishings and automobiles. An investment by a Vermont investor that is an

accredited investor within the meaning of the Federal securities laws (17 C.F.R. §230.501) is not subject to the foregoing limitations.

The minimum purchase amount is $2,500 in shares of our common stock. To satisfy the minimum purchase requirements for retirement

plans, unless otherwise prohibited by state law, a husband and wife may jointly contribute funds from their separate individual retirement

accounts ("IRAs) provided that each such contribution is made in increments of $500. You should note that an investment in shares of

our common stock will not, in itself, create a retirement plan and that, in order to create a retirement plan, you must comply with all

applicable provisions of the Internal Revenue Code of 1986, as amended (the "Code").

If you have satisfied the applicable minimum purchase requirement, any additional purchases must be in amounts of at least $500. The

investment minimum for subsequent purchases does not apply to shares purchased pursuant to our distribution reinvestment plan.

In the case of sales to fiduciary accounts, these suitability standards must be met by the person who directly or indirectly supplied the

funds for the purchase of the shares of our stock or by the beneficiary of the account.

These suitability standards are intended to help ensure that, given the long-term nature of an investment in shares of our stock, our

investment objective and the relative illiquidity of our stock, shares of our stock are an appropriate investment for those of you who

become stockholders. Our sponsor and those selling shares on our behalf must make every reasonable effort to determine that the purchase

of shares of our stock is a suitable and appropriate investment for each stockholder based on information provided by the stockholder in

the subscription agreement. Each selected broker-dealer is required to maintain for six years records of the information used to determine

that an investment in shares of our stock is suitable and appropriate for a stockholder.

In purchasing shares, custodians or trustees of employee pension benefit plans or IRAs may be subject to the fiduciary duties imposed

by the Employee Retirement Income Security Act of 1974, as amended ("ERISA"), or other applicable laws and to the prohibited transaction

rules prescribed by ERISA and related provisions of the Code. In addition, prior to purchasing shares, the trustee or custodian of an

employee pension benefit plan or an IRA should determine that such an investment would be permissible under the governing instruments

of such plan or account and applicable law.

1

PROSPECTUS SUMMARY

This summary highlights some of the information in this prospectus. It is not complete and may not contain all of the information that

you may want to consider. To understand this Offering fully, you should read the entire prospectus carefully, including the financial

statements beginning on page F-1 and the section entitled “Risk Factors” beginning on page 31 before making a decision to invest in

shares of our common stock.

Unless otherwise noted, the terms “we,” “us,” “our,” and “Company” refer to HMS Income Fund, Inc., a Maryland corporation. We

refer to HMS Adviser LP, a Texas limited partnership and an affiliate of Hines, as “HMS Adviser” or “our Adviser.” We refer to Hines

Securities, Inc. as our "Dealer Manager." We refer to Hines Interests Limited Partnership as “Hines” or “our Sponsor.” We refer to

Main Street Capital Corporation as “Main Street,” and we refer to MSC Adviser I, LLC, a wholly owned subsidiary of Main Street, as

“MSC Adviser.” The term “our Sub-Adviser,” as used in this prospectus, refers to Main Street until December 31, 2013 and to MSC

Adviser after that date. Our Adviser and Sub-Adviser are collectively referred to as “our Advisers.”

Our Company

HMS Income Fund, Inc. was formed as a Maryland corporation on November 28, 2011 under the General Corporation Law of the State

of Maryland. We are an externally managed, non-diversified closed-end investment company that has elected to be treated as a BDC

under the 1940 Act.

We have elected to be treated for U.S. federal income tax purposes as a regulated investment company (“RIC”) under Subchapter M of

the Code. As a result, we will generally not pay corporate-level U.S. federal income taxes on any net ordinary income or capital gains

that we distribute as dividends to our shareholders.

Our primary investment objective is to generate current income through debt and equity investments. A secondary objective is to generate

long-term capital appreciation through equity and equity-related investments, including warrants, convertible securities and other rights

to acquire equity securities. Our portfolio strategy calls for usis to invest primarily in illiquid debt and equity securities issued by LMM

companies, which generally have annual revenues between $10 million and $150 million, and Middle Market companies. Our Middle

Market investments are made in businesses that are generally larger in size than our LMM portfolio companies, with annual revenues

typically between $10 million and $3 billion. Our LMM and Middle Market portfolio investments generally range in size from $1 million

to $15 million. We categorize some of our investments in LMM and Middle Market companies as private loan ("Private Loan") portfolio

investments. Private Loan investments, often referred to in the debt markets as “club deals,” are investments, generally in debt instruments,

that we originate on a collaborative basis with other investment funds. Private Loan investments are typically similar in size, structure,

terms and conditions to investments we hold in our LMM portfolio and Middle Market portfolio. Our portfolio also includes other portfolio

investments ("Other Portfolio") investments which primarily consistconsisting of investments that are not consistent withmanaged by

third parties, which differ from the typical profiles for our LMM, Middle Market, or Private Loan investments, including investments

which may be managed by third parties.investments.

We previously registered for sale up to 150,000,000 shares of common stock pursuant to a registration statement on Form N-2 (File No.

333-178548) which was initially declared effective by the SEC on June 4, 2012 (the “Initial Offering”). The Initial Offering terminated

on December 1, 2015. The Company raised approximately $601.2 million under the Initial Offering, including proceeds from the

distribution reinvestment plan of approximately $22.0 million. On January 5, 2016, the SEC declared a new registration statement on

Form N-2 (File No. 333-204659), as amended, effective under which we registered the Offering.

We are advised and managed by the Adviser under an Investment Advisory and Administrative Services Agreement dated May 31, 2012

(the “Investment Advisory Agreement”). Under the Investment Advisory Agreement, the Adviser does not earn any profit under its

provision of administrative services to us. We and the Adviser also retained our Sub-Adviser pursuant to an Investment Sub-Advisory

Agreement (the “Sub-Advisory Agreement”). Under the Sub-Advisory Agreement, our Sub-Adviser identifies, evaluates, negotiates and

structures prospective investments, makes investment and portfolio management recommendations for approval by our Adviser, monitors

our investment portfolio and provides certain ongoing administrative services to our Adviser. As a result of the Sub-Advisory Agreement,

Main Street is an affiliate of the Company.

Our Sub-Adviser is a wholly owned subsidiary of Main Street, a New York Stock Exchange-listed BDC, with total assets in excess of

$1.9 billion$2.0 billion as of March 31, 2016June 30, 2016. Main Street is a principal investment firm primarily focused on providing

debt and equity financing to LMM companies and debt financing to Middle Market companies.

As a BDC, we are subject to certain regulatory restrictions in making our investments, including limitations on our ability to co-invest

with certain affiliates. However, we received exemptive relief from the SEC that permits us, subject to certain conditions, to co-invest

with Main Street in certain transactions originated by Main Street and/or our Advisers. The exemptive relief permits us, and certain of

our directly or indirectly wholly owned subsidiaries on the one hand, and Main Street and/or certain of its affiliates on the other hand, to

2

co-invest in the same investment opportunities where such investment may otherwise be prohibited under Section 57(a)(4) of the 1940

Act.

In addition to the co-investment program described in this prospectus and in the exemptive relief, we may continue to co-invest in

syndicated deals and secondary loan market purchases in accordance with applicable regulatory guidance or interpretations, which may

include instances where price is the only negotiated point.

The principals of our Advisers have access to a broad network of relationships with financial sponsors, commercial and investment banks,

Middle Market companies and leaders within a number of industries that we believe produce significant investment opportunities. We

intend to leverage the experience and expertise of the principals of our Advisers to execute our investment strategies. Our Adviser’s senior

management team, through affiliates of Hines, has sponsored and manages three publicly offered and non-traded real estate investment

trusts ("REITs"), which collectively had investments in aggregate gross real estate assets (based on purchase price) of approximately $8.2

billion$9.0 billion as of March 31, 2016June 30, 2016. Hines is a fully integrated real estate investment and management firm which,

with its predecessor, has been investing in real estate assets and providing acquisition, development, financing, property management,

leasing and disposition services for over 59 years. This experience includes credit evaluation and underwriting of tenants across numerous

industries and geographic markets, including Middle Market companies. Main Street’s primary investment focus is providing customized

debt and equity financing to LMM companies and debt capital to Middle Market companies that operate in diverse industry sectors. As

of March 31, 2016, Main Street had debt and equity investments with an aggregate fair value of approximately $1.8 billion in over 200

portfolio companies.

Status of Our Ongoing Offering

The Initial Offering commenced on June 4, 2012 and terminated on December 1, 2015. The Company raised total gross proceeds of

approximately $611.4 million, including the value from our initial formation transaction of $10.1 million and gross sales and distribution

reinvestment plan proceeds of approximately $601.2 million. On January 5, 2016, the Offering commenced. The following table

summarizes the sales of shares of our common stock under the Offering, on a monthly basis from commencement through June 30,

2016.On August 11, 2016, our board of directors authorized the closing of the Offering to new investors on or about March 31, 2017.

However, our board of directors retained its right to provide final approval on the specific terms of the closing, including its right to

accelerate the closing or to continue the Offering if our board of directors determines that it would be in the best interests of us and our

stockholders to do so.

The following table summarizes the sales of shares of our common stock under the Offering, on a monthly basis from commencement

through August 31, 2016.

Gross Proceeds Including

Proceeds From DRIP Plan Shares Issued(1) Average Price per Share(2)

2016

January 2,157,067 252,696 8.54

February 5,347,878 635,365 8.42

March 13,048,662 1,558,317 8.37

April 11,203,890 1,316,028 8.51

May 11,692,252 1,349,407 8.66

June 11,309,083 1,301,159 8.69

July 8,789,418 1,012,230 8.68

August 9,236,038 1,050,993 8.79

$ 63,548,250

$ 54,758,832

7,425,202

6,412,972

$ 8.56

$ 8.54 :

(1) The number of shares of our common stock sold includes 1,425,6971,665,843 shares of common stock purchased through our distribution

reinvestment plan.

(2) All shares of common stock were sold at offering prices between $8.50 and $9.00 per share, depending on the amount of discounts or commissions

waived by our Dealer Manager. Effective with the weekly closing on July 28, 2016, we offered shares at $8.90 per share.

Portfolio Update

During the threesix months ended March 31June 30, 2016, we funded investment purchases of approximately $83.1$181.9 million and

had twoseven investments under contract to purchase as of March 31June 30, 2016, for approximately $3.6$28.3 million, which settled

or we scheduled to settle after March 31June 30, 2016. We also received proceeds from sales and repayments of existing portfolio

investments of approximately $47.4$107.9 million including $37.5$61.5 million in sales. Additionally, we had threetwo investments

under contract to sell as of March 31June 30, 2016, for approximately $11.8$11.2 million, which represented the contract sales price.

3

The combined result of whichthese transactions increased our portfolio, on a cost basis, by approximately $19.1$75.8 million, or 2.1%8.4%,

and the number of portfolio investments by seven17, or 4.8%11.0%, compared to the portfolio as of December 31, 2015.

As of March 31June 30, 2016, the largest investment in an individual portfolio company represented approximately 2.4%2.1% of our

portfolio’s fair value with the remaining investments in an individual portfolio company ranging from 0.03%0.02% to 1.9%.1.8%. The

average investment in our portfolio is approximately $5.6$5.7 million or 0.6% of the total portfolio. As a result of these transactions, our

portfolio has become increasingly broadened across individual portfolio investments, geographic regions, and industries. Further, our

total portfolio's investment composition (excluding our Other Portfolio investments) at fair value is comprised of 80.0%79.4% first lien

debt securities, 16.5%15.5% second lien debt securities, with the remainder in unsecured debt investments and equity investments. First

lien debt securities have priority over subordinated debt owed by the issuer with respect to the collateral pledged as security for the loan.

Due to the relative priority of payment of first lien investments, these generally have lower yields than lower priority, less secured

investments. As of March 31, 2016June 30, 2016, approximately 85.3%84.2% of our LMM, Private Loan, and Middle Market portfolio

debt investments (based on cost) contained floating interest rates, the majority of which had index floors between 100 and 150 basis

points. The Company generally invests in floating rate debt instruments, meaning that the interest rate payable on such instrument resets

periodically based upon changes in a specified interest rate index, usually the one-month LIBOR, which was 0.4%0.5% as of March 31,

2016June 30, 2016. However, many of our investments provide as well that the annualized rate of interest on such instruments will never

fall below a level, or floor, between 100 and 150 basis points, equal to 1.0% to 1.5%, regardless of the level of the specified index rate.

As of March 31June 30, 2016, we had investments in 8380 Middle Market debt investments, 2024 Private Loan debt investments, 2224

LMM debt investments, 1924 LMM equity investments, sevenone Middle Market equity investment, eight Private Loan equity investments

and three Other Portfolio investments with an aggregate fair value of approximately $857.8$930.4 million, a cost basis of approximately

$923.8$980.5 million, and a weighted average effective annual yield of approximately 8.2%.8.4%. The weighted average annual yield

was calculated using the effective interest rates for all investments at March 31June 30, 2016, including accretion of original issue discount

and amortization of the premium to par value, the amortization of fees received in connection with transactions, and assumes zero yield

for investments on non-accrual status. Approximately 80.0%Approximately79.4% and 16.5%15.5% of our portfolio investments at fair

value (excluding our Other Portfolio investments) were secured by first priority liens and second priority liens on portfolio company

assets, respectively, with the remainder in unsecured debt investments and equity investments.

During the year ended December 31, 2015, we funded investment purchases of approximately $631.1 million and had five investments

under contract to purchase as of December 31, 2015, for approximately $11.7 million, which settled or we scheduled to settle after

December 31, 2015. We also received proceeds from sales and repayments of existing portfolio investments of approximately $176.1

million including $45.7 million in sales. Additionally, we had one investment under contract to sell as of December 31, 2015, for

approximately $2.0 million, which represented the contract sales price. The combined result of which increased our portfolio, on a cost

basis, by approximately $417.1 million, or 85.5%, and the number of portfolio investments by 38, or 34.9%, compared to the portfolio

as of December 31, 2014. As of December 31, 2015, the largest investment in an individual portfolio company represented approximately

2.3% of our portfolio’s fair value with the remaining investments in an individual portfolio company ranging from 0.03% to 1.8%. The

average single investment in our portfolio is approximately $5.8 million or 0.7% of the total portfolio. As a result of these transactions,

our portfolio has become increasingly broadened across individual portfolio investments, geographic regions, and industries. Further,

our total portfolio's investment composition (excluding our Other Portfolio investments) at fair value is comprised of 80.3% first lien

debt securities, 16.7% second lien debt securities, with the remainder in unsecured debt investments and equity investments. First lien

debt securities have priority over subordinated debt owed by the issuer with respect to the collateral pledged as security for the loan. Due

to the relative priority of payment of first lien investments, these generally have lower yields than lower priority, less secured investments.

Further, 83.7% of our portfolio debt investments bear interest at a variable rate, though a majority of the investments with variable rates

are subject to contractual minimum base interest rates between 100 and 150 basis points.

As of December 31, 2015, we had debt investments in 83 Middle Market investments, 20 Private Loan investments, 19 LMM debt

investments, 17 LMM equity investments, five Private Loan equity investments and three Other Portfolio investment with an aggregate

fair value of approximately $853.0 million, a cost basis of approximately $904.7 million, and a weighted average effective annual yield

of approximately 8.3%. The weighted average annual yield was calculated using the effective interest rates for all debt investments at

December 31, 2015, including accretion of original issue discount and amortization of the premium to par value, the amortization of fees

received in connection with transactions, and assumes zero yield for investments on non-accrual status.

Risk Factors

An investment in shares of our common stock involves a high degree of risk and may be considered speculative. You should carefully

consider the information found in “Risk Factors” in this prospectus before deciding to invest in shares of our common stock. The following

are some of the risks you will take in investing in our shares:

• We may be unable to achieve our investment objectives.

4

• Deterioration in the economy and financial markets increases the likelihood of adverse effects on our financial position and

results of operations. Such economic adversity could impair our portfolio companies’ financial positions and operating results

and affect the industries in which we invest, which could, in turn, harm our operating results.

• The amount of our distributions to our stockholders is uncertain. Portions of the distributions that we pay may represent a return

of capital to you for U.S. federal income tax purposes which will lower your tax basis in your shares and reduce the amount of

funds we have for investment in targeted assets. A return of capital is a return of your investment rather than earnings or gains

derived from our investment activities. We may not be able to pay you distributions, and our distributions may not grow over

time.

• We intend to seek to complete a liquidity event within four to six years following the end of our offering period. However, there

can be no assurance that we will be able to complete a liquidity event.

• A significant portion of our investment portfolio is, and will continue to be, recorded at fair value as determined in good faith

by our board of directors and, as a result, there is and will be uncertainty as to the ultimate market value of our portfolio

investments.

• Our board of directors may change our operating policies and investment strategies without prior notice or stockholder approval,

the effects of which may be adverse to you as an investor.

• Our Advisers and their respective affiliates, including our officers and certain of our directors, may have conflicts of interest as

a result of compensation arrangements, time constraints and competition for investments, which they will attempt to resolve in

a fair and equitable manner, but which may result in actions that are not in your best interests.

• The potential for our Advisers to earn incentive fees may create an incentive for the Advisers to invest our funds in securities

that are riskier or more speculative than would otherwise be the case, and our Advisers may have an incentive to increase portfolio

leverage in order to earn higher management fees.

• We have borrowed funds to make investments. As a result, we are exposed to the risks of borrowing, also known as leverage,

which may be considered a speculative investment technique. Leverage magnifies the potential for gain or loss on amounts

invested in us and increases the risk of investing in us.

• Our investments tend to be senior secured term loans, second lien loans, mezzanine debt and selected equity investments in

portfolio companies, which may be risky, and we could lose all or part of our investment in any or all of our portfolio companies.

• In the event that our Adviser collects a fee on an investment that provides for payment-in-kind ("PIK") interest and such investment

fails, our Adviser would not be required to repay the fee that it received with respect to that investment.

• Most loans in which we invest are not rated by a rating agency or, if they were so rated, would be rated below investment grade.

Such below investment grade debt securities are commonly known as "junk" securities and are regarded as having predominantly

speculative characteristics with respect to the obligor’s capacity to pay interest and repay principal.

• We are subject to financial market risks which may have a substantial negative impact on our investments.

• Changes in interest rates may have a substantial negative impact on our investments.

• Investors will not know the purchase price per share at the time they submit their subscription agreements and could receive

fewer shares of common stock than anticipated if our Pricing Committee of the board of directors determines to increase the

offering price to comply with the requirement that we are prohibited from selling shares below our NAV per share.

• If we are unable to raise substantial funds in our ongoing, continuous “best efforts" offering, we will be limited in the number

and type of investments we may make, and the value of your investment in us may be reduced in the event our assets under-

perform.

• Our shares of common stock are not listed on an exchange or quoted through a quotation system and will not be listed for the

foreseeable future, if ever. Therefore, you will have limited liquidity and may not receive a full return of your invested capital

if you sell your shares of common stock.

See “Risk Factors” and the other information included in this prospectus for a discussion of factors you should carefully consider before

deciding to invest in shares of our common stock.

Our Market Opportunity

BDCs were created by Congress in 1980 as investment companies that were intended to foster investment in smaller and developing

companies, and to encourage capital formation for business in the United States. According to the U.S. Census Bureau's most recently

published data, as of 2007, there were approximately 197,000 companies in the United States with revenues between $10 million and

$150 million. We believe many LMM and Middle Market companies are unable to obtain sufficient financing from traditional financing

sources, including other BDCs, because of the underwriting requirements of these financing sources. We believe that the lack of focus

by these other financing sources on the investment opportunities available from Middle Market and LMM debt and equity investing

provides us with a compelling opportunity to generate favorable risk-adjusted returns and consistent cash distributions while also fulfilling

the original capital formation mission of BDCs.

5

Due to evolving market trends, we believe traditional lenders and other sources of private investment capital, including certain other

BDCs, have focused their efforts on larger companies and transactions. We believe this dynamic is attributable to several factors, including

the consolidation of commercial banks and the aggregation of private investment funds into larger pools of capital that are necessarily

focused on these larger investments to generate meaningful yield. In addition, many funding sources do not have relevant experience in

dealing with some of the unique business issues facing LMM companies. Consequently, we believe that LMM companies historically

have been and are currently underserved. Additionally, due to stricter financial regulations since the financial crisis, banks have reduced

their exposure and are less likely to make loans to midsize and smaller companies that they perceive as riskier. These factors create the

opportunity for us to meet the financing requirements of Middle Market and LMM companies while also negotiating favorable transaction

terms and equity participation opportunities.

Potential Competitive Strengths

We believe that we have the following competitive advantages over other publicly-traded BDCs and other public non-traded BDCs:

• affiliates of our Adviser have more than 59 years of experience in evaluating and underwriting credit of companies in numerous

industries and geographic markets including Middle Market companies in connection with acquiring and developing over 389

million square feet and managing over 170 million square feet of retail, office and industrial real estate to a wide variety of

tenants, including Middle Market companies (see “Prospectus Summary-About Our Adviser,” “Investment Objectives and

Strategies-About Our Adviser,” “Investment Objectives and Strategies-About Our Sponsor” and “Portfolio Management - Our

Investment Adviser”);

• Main Street has substantial experience in operating as a BDC investing in the types of companies and securities we typically

acquire, and expect to acquire in the future, and an established record of creating stockholder value through increasing

distributions, periodic capital gains and stable NAVs (see “Prospectus Summary-About Main Street,” “Investment Objectives

and Strategies-About Our Sub-Adviser” and “Portfolio Management-Our Sub-Adviser”); and

• the principals of Hines, our Adviser and Main Street have extensive relationships with loan syndication and trading desks, lending

groups, management teams, investment bankers, business brokers, attorneys, accountants and other persons whom we believe

will continue to provide us with significant investment opportunities (see "Management" and "Portfolio Management").

Our Investment Process

Under the terms of the Investment Advisory Agreement, HMS Adviser oversees the management of our activities and is responsible for

making investment decisions with respect to and providing day-to-day management and administration of our investment portfolio. Our

Adviser has engaged the Sub-Adviser under the Sub-Advisory Agreement to identify, evaluate, negotiate and structure our prospective

investments, make investment and portfolio management recommendations for approval by our Adviser, monitor our investment portfolio

and provide certain ongoing administrative services to the Adviser.

Our Sub-Adviser identifies and originates the majority of our investment opportunities. Each investment opportunity is first evaluated

by our Sub-Adviser for suitability for our portfolio. Our Sub-Adviser performs due diligence procedures and provides to our Adviser due

diligence information with respect to the investment. Our Sub-Adviser recommends investments to our Adviser, whose investment

committee then independently evaluates each investment considering then the analysis, due diligence information and recommendation

provided by our Sub-Adviser. In addition, our Sub-Adviser monitors our investment portfolio on an ongoing basis and makes

recommendations to the Adviser regarding ongoing portfolio management. Our Adviser makes all decisions to acquire, hold or sell

investments for us except those decisions reserved for our board of directors.

As a BDC, we are subject to certain regulatory restrictions in making our investments, including limitations on our ability to co-invest

with certain affiliates. However, we have received exemptive relief from the SEC that permits us, subject to certain conditions, to co-

invest with Main Street in certain transactions originated by Main Street and/or our Advisers. The exemptive relief permits us, and certain

of our directly or indirectly wholly owned subsidiaries on one hand, and Main Street and/or certain of its affiliates on the other hand, to

co-invest in the same investment opportunities where such investment would otherwise be prohibited under Section 57(a)(4) of the 1940

Act. Under the co-investment program, we expect that co-investment between us and Main Street will be the norm rather than the

exception, as substantially all potential co-investments that are appropriate investments for us should also be appropriate investments for

Main Street, and vice versa. Limited exceptions to co-investing will be based on available capital, diversification and other relevant

factors. Accordingly, our Sub-Adviser treats every potential investment in customized LMM securities evaluated by Main Street as a

potential investment opportunity for us, determines the appropriateness of each potential investment for co-investment by us, provides

to our Adviser, in advance, information about each potential investment that it deems appropriate for us and proposes an allocation

according to an investment allocation policy reviewed periodically by our board of directors between us and Main Street. If our Adviser

deems such potential co-investment transaction and proposed allocation appropriate for us, our Adviser presents the transaction and the

proposed allocation to the members of our board of directors who are (1) not interested persons of us or Main Street, and (2) who do not

6

have a financial interest in the proposed transaction or the proposed portfolio company, which directors are referred to as “Eligible

Directors,” and our Sub-Adviser presents the transaction and the proposed allocation for Main Street to the Eligible Directors of the Main

Street board of directors. Each board of directors, including a majority of the Eligible Directors of each board of directors, must approve

each proposed co-investment transaction and the associated allocations therewith prior to the consummation of any co-investment

transaction. No independent director on our board of directors or Main Street’s board of directors may have any direct or indirect financial

interest in any co-investment transaction or any interest in any related portfolio company, other than through an interest (if any) in our

or Main Street’s securities, as applicable. Additional information regarding the operation of the co-investment program is set forth in the

order granting our exemptive relief, which may be reviewed on the SEC’s website at www.sec.gov.

In addition to the co-investment program described in this prospectus and in the exemptive relief, we may continue to co-invest in

syndicated deals and secondary loan market purchases in accordance with applicable regulatory guidance or interpretations, which may

include instances where price is the only negotiated point.

We expect that the debt in which we invest will generally have stated terms of three to seven years. However, we are in no way limited

with regard to the maturity or duration of any debt investment we may make, and we do not have a policy in place with respect to stated

maturities of debt investments.

We have employed, and in the future intend to employ, leverage as market conditions permit and at the discretion of our Adviser, but in

no event will leverage employed exceed 50% of the value of our assets, as required by the 1940 Act.

About Our Adviser

Our Adviser is a Texas limited partnership formed on April 13, 2012 that is registered as an investment adviser under the Investment

Advisers Act of 1940, as amended (the “Advisers Act”). Our Adviser is wholly-owned by Hines. Hines is indirectly owned and controlled

by Gerald D. Hines and Jeffrey C. Hines.

Hines has sponsored three publicly offered and non-traded REITs: Hines Real Estate Investment Trust, Inc. ("Hines REIT"), Hines Global

REIT, Inc. ("Hines Global REIT"), and Hines Global REIT II, Inc. ("Hines Global REIT II"). These REITS collectively had investments

in aggregate gross real estate assets (based on purchase price) of approximately $8.2 billion$9.0 billion as of March 31, 2016June 30,

2016. Sherri W. Schugart, our Chairman, President and Chief Executive Officer, and Ryan T. Sims, our Chief Financial Officer and

Secretary, joined Hines in 1995 and 2003, respectively, and have substantial experience in private equity, real estate acquisitions and

dispositions, public company management and administration and finance and have served as executive officers of companies in the

REIT and investment real estate industries.

About Our Sub-Adviser

Pursuant to the Sub-Advisory Agreement, MSC Adviser, a wholly owned subsidiary of Main Street and a registered investment adviser,

acts as our investment sub-adviser to identify, evaluate, negotiate and structure prospective investments, make investment and portfolio

management recommendations for approval by our Adviser, monitors our investment portfolio and provides certain ongoing administrative

services to our Adviser. We believe the members of Main Street's investment team have significant experience in corporate finance,

mergers and acquisitions and private equity investing.

About Main Street

Main Street is an internally managed, listed BDC whose common stock trades on the New York Stock Exchange under the ticker symbol

“MAIN". The same investment professionals who provide investment sub-advisory services to us comprise the investment management

team of Main Street. Main Street has developed a reputation in the market place as a responsible and efficient source of financing, which

has created a stream of proprietary deal flow. As of March 31, 2016June 30, 2016, Main Street had debt and equity investments in LMM

securities and over-the-counter debt securities with an aggregate fair value of approximately $1.8 billion$1.9 billion in over 200 portfolio

companies. We believe that our Sub-Adviser’s expertise in analyzing, valuing, structuring, negotiating and closing transactions provides

us with a competitive advantage in offering customized financing solutions to LMM companies and in executing investments in over-

the-counter debt securities. Main Street and our Sub-Adviser are based in Houston, Texas.

About Our Sponsor

Hines is our Sponsor. Hines is a fully integrated global real estate investment and management firm and, with its predecessor, has been

investing in real estate and providing acquisition, development, financing, property management, leasing and disposition services for

over 59 years. Hines provides real estate investment and management services to numerous investors and partners including pension

plans, domestic and foreign institutional investors, high net worth individuals and retail investors. Hines is indirectly owned and controlled

by Gerald D. Hines and his son Jeffrey C. Hines. As of December 31, 2015June 30, 2016, Hines had approximately $89 billion$93 billion

7

in assets under management, which included approximately $43 billion$48 billion in assets that Hines managed as a fiduciary, including

HMS Income Fund's assets, and included approximately $47 billion$45 billion for which Hines provided third-party property management

services. This portfolio represents assets owned by Hines, its affiliates and numerous third-party investors, including pension plans,

domestic and foreign institutional investors, high net worth individuals and retail investors as well as assets Hines serves in an investment

management role as a fiduciary, regardless of equity participation. Please see “Investment Objective and Strategies — About Our Sponsor”

for more information regarding Hines.

Plan of Distribution

We are offering on a continuous basis up to $1,500,000,000 worth of shares of our common stock in this Offering. Our Dealer Manager

is not required to sell any specific number or dollar amount of shares but will use its best efforts to sell the shares offered. The minimum

permitted purchase by a single subscriber is $2,500 in shares of our common stock. Subject to the requirements of state securities regulators

with respect to sales to residents of their states, there is no minimum number of shares required to be sold in this Offering.

8

We held our initial closing under the Initial Offering on September 17, 2012, and currently conduct closings on a weekly basis. All

subscription payments are placed in a segregated interest-bearing account and held in trust for our subscribers’ benefit, pending release

to us at the next scheduled weekly closing. We currently offer shares of our common stock on a continuous basis to the extent that our

NAV per share increases, we will sell shares of our common stock at a price necessary to ensure that shares of our common stock are not

sold at a price per share, after deduction of selling commissions and Dealer Manager fees, that is below our NAV per share . In the event

of a material decline in our NAV per share which we deem to be non-temporary, and that results in a 2.5% or higher decrease of our NAV

per share below our then-current net offering price, and subject to certain other conditions, we will reduce our offering price accordingly.

Because the price per share of our common stock may change, persons who subscribe for shares in this Offering must submit subscriptions

for a fixed dollar amount rather than for a number of shares and, as a result, may receive fractional shares of our common stock. Promptly

following any adjustment to the offering price per share, we will file a prospectus supplement with the SEC disclosing the adjusted

offering price, and we will also post the updated information on our website at www.HinesSecurities.com. Information contained on our

website is not incorporated by reference into this prospectus, and you should not consider that information to be part of this prospectus.

The following table summarizes adjustments we have made to our per share public offering price and the closing date on which such

adjustments were effective.

First Effective Closing Date Per Share Public Offering Price

June 4, 2012 $ 10.00

January 15, 2015 $ 9.75

May 7, 2015 $ 9.90

October 8, 2015 $ 9.70

November 12, 2015 $ 9.55

January 1, 2016 $ 9.00

January 21, 2016 $ 8.80

February 4, 2016 $ 8.60

February 18, 2016 $ 8.50

March 24, 2016 $ 8.60

April 21, 2016 $ 8.70

May 5, 2016 $ 8.80

July 28, 2016 $ 8.90

Suitability Standards

Pursuant to applicable state securities laws, shares of common stock offered through this prospectus are suitable only as a long-term

investment for persons of adequate financial means who have no need for liquidity in this investment. There is no public market for the

shares, nor is one expected to develop, which means that it will be difficult for stockholders to sell their shares. As a result, we have

established suitability standards that require investors to have either (i) a net worth (not including home, furnishings, and personal

automobiles) of at least $70,000 and an annual gross income of at least $70,000, or (ii) a net worth (not including home, furnishings, and

personal automobiles) of at least $250,000. Our suitability standards also require that a potential investor (1) be positioned to reasonably

benefit from an investment in shares of our common stock based on such investor’s overall investment objectives and portfolio structuring;

(2) be able to bear the economic risk of the investment based on the prospective stockholder’s overall financial situation; and (3) have

an apparent understanding of (a) the fundamental risks of the investment, (b) the risk that such investor may lose his or her entire

investment, (c) the lack of liquidity of the shares, (d) the background and qualifications of our Advisers and (e) the tax consequences of

the investment. Certain states impose heightened suitability standards on investors in those jurisdictions. For additional information, see

“Suitability Standards.”

How to Subscribe

Investors who meet the suitability standards described in this prospectus may purchase shares of our common stock. Investors seeking

to purchase shares of our common stock should proceed as follows:

• Read this entire prospectus and all appendices and supplements accompanying this prospectus.

• Complete the execution copy of the subscription agreement. A specimen copy of the subscription agreement, including

instructions for completing it, is included in this prospectus as Appendix A.

• Deliver a check for the full purchase price of the shares of our common stock being subscribed for along with the completed

subscription agreement to the selected broker-dealer. You should make your check payable to “HMS Income Fund, Inc.” You

must initially invest at least $2,500 in shares of our common stock to be eligible to participate in this Offering. Any purchases

thereafter must be at least $500, except for purchases made pursuant to our distribution reinvestment plan.

9

• By executing the subscription agreement and paying the total purchase price for the shares of our common stock subscribed for,

each investor attests that he or she meets the suitability standards as stated in the subscription agreement and agrees to be bound

by all of its terms.

All subscription proceeds are placed in a segregated interest-bearing account and held in trust for our subscribers’ benefit pending

acceptance of subscriptions and closing the sale and issuance of shares. We accept subscriptions and admit new stockholders at weekly

closings. Subscriptions are effective only upon our acceptance, and we reserve the right to reject any subscription in whole or in part.

Subscriptions will be accepted or rejected within 30 days of receipt by us and, if rejected, all funds shall be returned to subscribers without

interest and without deduction for any expenses within ten business days from the date the subscription is rejected. We are not permitted

to accept a subscription for shares of our common stock until at least five business days after the date you receive the final prospectus.

In addition, certain states may require us to sell a minimum number or dollar amount of shares prior to selling shares to residents of those

states.

An approved trustee must process and forward to us subscriptions made through IRAs, Keogh plans and 401(k) plans. In the case of

investments through IRAs, Keogh plans and 401(k) plans, we will send the confirmation and notice of our acceptance or rejection to the

trustee.

Use of Proceeds

We intend to use the net proceeds from this Offering to make investments in accordance with our investment objective and strategies

described in this prospectus or any prospectus supplement, to make investments in marketable securities and idle funds investments,

which may include investments in secured intermediate term bank debt, rated debt securities and other income producing investments,

to pay our operating expenses and other cash obligations, and for general corporate purposes. Our ability to achieve our investment

objective may be limited to the extent that any net stock offering proceeds, pending full investment, are held in interest-bearing deposits

or other short-term instruments.

Credit Facilities

On March 11, 2014, we entered into a $70 million senior secured revolving credit facility (the "Capital One Credit Facility") with Capital

One, National Association ("Capital One"), as the administrative agent, and with Capital One and the other banks (collectively, the

"Lenders"). The Capital One Credit Facility has subsequently been amended on multiple occasions, most recently on May 29, 2015,

increasing the revolver commitments to $125 million, with an accordion provision allowing borrowing capacity to increase to $150

million. Borrowings under the Capital One Credit Facility bear interest, subject to the Company’s election, on a per annum basis equal

to (i) the adjusted LIBOR rate plus 2.75% or (ii) the base rate plus 1.75%. The base rate is defined as the higher of (a) the prime rate or

(b) the Federal Funds Rate (as defined in the credit agreement) plus 0.5%. The adjusted LIBOR rate is defined in the credit agreement

for the Capital One Credit Facility as the one-month LIBOR rate plus such amount as adjusted for statutory reserve requirements for

Eurocurrency liabilities. As of March 31June 30, 2016, the one-month LIBOR rate was 0.4%.0.5%. We pay an annual unused commitment

fee of 0.25% on the unused revolver commitments if more than 50% of the revolver commitments are being used and an annual commitment

fee of 0.375% on the unused revolver commitments if less than 50% of the revolver commitments are being used. The Capital One Credit

Facility has a three-year term, maturing March 11, 2017, with two one-year extension options, subject to approval of the Lenders.

The Capital One Credit Facility, as amended, permits the creation of certain "Structured Subsidiaries," which are not guarantors under

the Capital One Credit Facility and which are permitted to incur debt outside of the Capital One Credit Facility. Borrowings under the

Capital One Credit Facility are secured by all of our assets, other than the assets of the Structured Subsidiaries, as well as all of the assets,

and a pledge of equity ownership interests, of any future subsidiaries of the Company (other than Structured Subsidiaries), which would

be joined as guarantors. The credit agreement for the Capital One Credit Facility contains affirmative and negative covenants usual and

customary for credit facilities of this nature, including: (i) maintaining an interest coverage ratio of at least 2.0 to 1.0 (ii) maintaining an

asset coverage ratio of at least 2.25 to 1.0 and (iii) maintaining a minimum consolidated tangible net worth, excluding Structured

Subsidiaries, of at least $50 million. Further, the Capital One Credit Facility contains limitations on incurrence of other indebtedness

(other than by Structured Subsidiaries), limitations on industry concentration, and an anti-hoarding provision to protect the collateral

under the Capital One Credit Facility. Additionally, we must provide information to Capital One on a regular basis, preserve our corporate

existence, comply with applicable laws, including the 1940 Act, pay obligations when they become due, and invest any stock offering

proceeds in accordance with our investment objectives and strategies (as set forth in the Capital One Credit Facility). Further, the credit